The #1 Provider in Real Estate DSCR Loans!

Call Us Today!

We Provide Real Estate Investor Loans In All 50 States

***Please Note- We Do Not Provide Personal Loans***

We Provide

Real Estate Investor Loans In All 50 States

Flexible DSCR Loans Tailored for Real Estate Investors

Invest in Real Estate Without Income Verification

Fast, Flexible Financing to Grow Your Portfolio

Close in 2-3 Weeks

Simple application process

No Income Verification Required

As Little As

15% Down

FAST & EASY PROCESS

Designed For Real Estate Investors

Faster Closing Times

Close in 2-3 Weeks

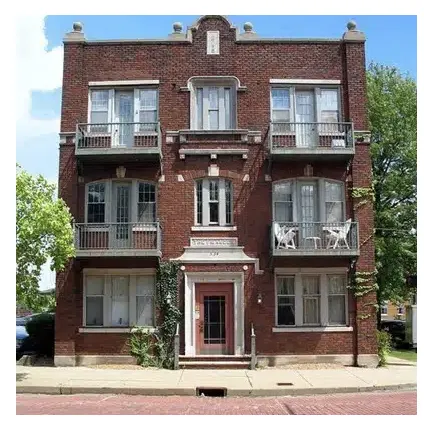

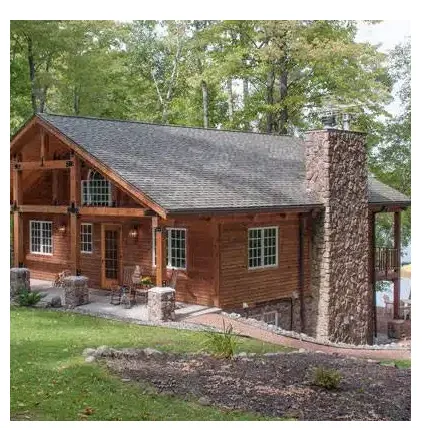

Covers All Types of Rental Properties

Whether you’re investing in single-family homes, multi-unit buildings, or vacation rentals, our loans cover all property types, giving you the freedom to expand your portfolio as you see fit.

Rental portfolios

Commercial Properties

Airbnb & VRBO

OUR PROCESS

Fast & Easy Application Process

STEP 1

Pre-Qualification

Begin by filling out a simple online form or directly consulting with our loan specialists to quickly identify the best loan options based on your investment goals and property details.

STEP 2

Application and Documentation

Once pre-qualified, submit key documents like property ownership and rental income proof; our streamlined process makes this quick and hassle-free.

STEP 3

Approval and Closing

After reviewing your application, we quickly approve and close your loan, finalizing terms and disbursing funds within 2-3 weeks.

OUR SPECIALTY

Flexibility and efficiency in financing your real estate investments with our specialized DSCR loans.

Who are DSCR loans for?

DSCR loans are designed for real estate investors that own rental properties.

Are DSCR loans available for short-term rentals?

Yes!

Short term rentals like AirBNB properties are the fastest growing type of DSCR loans.

Can I finance a property in an LLC?

Yes, you can obtain a DSCR loan through an LLC. Many real estate investors prefer using an LLC for such loans to separate personal and investment finances, and for potential liability protection. However, lenders may have specific requirements for LLCs, such as the LLC’s age, structure, and financial history. It’s advisable to discuss with the lender and a legal advisor to ensure compliance and to understand the implications of taking a loan in the name of an LLC.

Ongoing Support:

Throughout the process, borrowers have access to a dedicated loan officer who can answer questions and provide updates on the loan status.

CONTACT US

Feel free to chat with us!

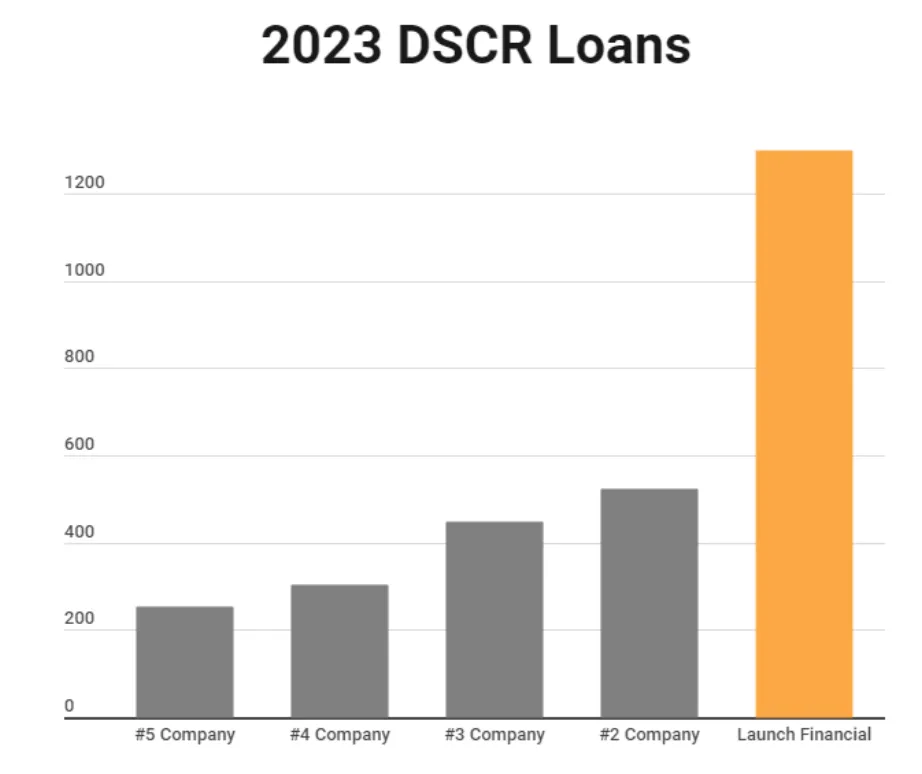

What The Stats Say

DSCR Loan Leader

In 2023 we processed more DSCR loans than our #2 and #3 competitors combined. By focusing our business on DSCR loans we have been able to develop a level of expertise that no other company offers.

*By clicking on the “Submit” button above, you consent, acknowledge, and agree to that you are providing express “written” consent for Think Mortgage, Launch Financial Group or an authorized third party on their behalf to call you (including through automated means; e.g. autodialing, text and pre-recorded messaging) via telephone, mobile device (including SMS and MMS – charges may apply) and/or email, even if your telephone number is currently listed on any internal, corporate, state, federal or national Do-Not-Call (DNC) list.

Website crafted with ❤️ by ResProAI